Submitted by Colburn Wealth Management, LLC on May 15th, 2015

In honor of Berkshire Hathaway celebrating their 50 year anniversary, here is a chart showing their performance vs the S&P 500 over the last ten years. Because of Berkshire's size, they won't be able to replicate their performance of the past. However, stock may represent an attractive holding for long term investors.

Submitted by Colburn Wealth Management, LLC on May 11th, 2015

Accumulation is a key facet of reaching your retirement goals. However, we tend to see far less about portfolio drawdown, or decumulation—the logistics of managing a portfolio from which you're simultaneously extracting living expenses during retirement. This can be even more complicated than accumulating assets.

Submitted by Colburn Wealth Management, LLC on May 5th, 2015

The choice to use index funds rather than actively managed funds is a significant one. Index funds tend to be rather straightforward, easy-to-own, and cost-effective investment vehicles. But, just like actively managed funds, index funds also have their differences that investors should be aware of.

Submitted by Colburn Wealth Management, LLC on April 27th, 2015

Submitted by Colburn Wealth Management, LLC on April 20th, 2015

Submitted by Colburn Wealth Management, LLC on April 16th, 2015

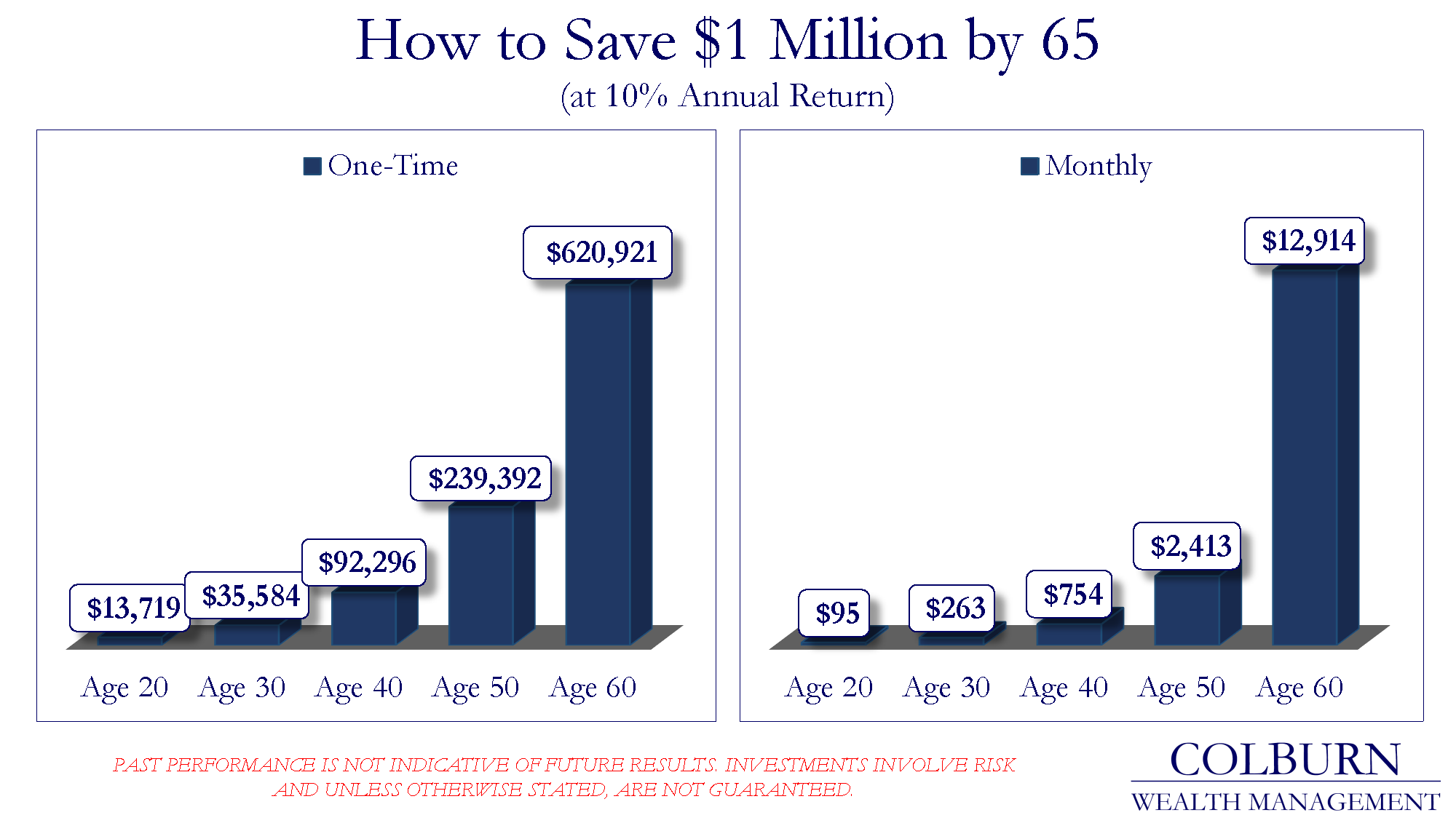

We all know we should begin investing as early as possible to take the greatest advantage of compound interest growth. The graphics below highlight the power of compound growth based on the average long-term returns of the U.S. stock market.

Submitted by Colburn Wealth Management, LLC on April 13th, 2015

Investors with cash holdings want to invest them in something safe that will earn at least a little interest. Money markets and short-term bond funds are good places to start. Money markets come in two flavors: money-market accounts offered by banks and money-market funds offered by mutual fund companies.

Submitted by Colburn Wealth Management, LLC on April 6th, 2015

Accumulation is a key facet of reaching your retirement goals. However, we tend to see far less about portfolio drawdown, or decumulation—the logistics of managing a portfolio from which you're simultaneously extracting living expenses during retirement. This can be even more complicated than accumulating assets.

Submitted by Colburn Wealth Management, LLC on March 30th, 2015

Accumulation is a key facet of reaching your retirement goals. However, we tend to see far less about portfolio drawdown, or decumulation—the logistics of managing a portfolio from which you're simultaneously extracting living expenses during retirement, which can be even more complicated.

Submitted by Colburn Wealth Management, LLC on March 23rd, 2015

If domestic stocks are performing ably, why invest elsewhere? When the S&P 500 is returning double digits, it may seem unnecessary to include shares from foreign companies in your portfolio.