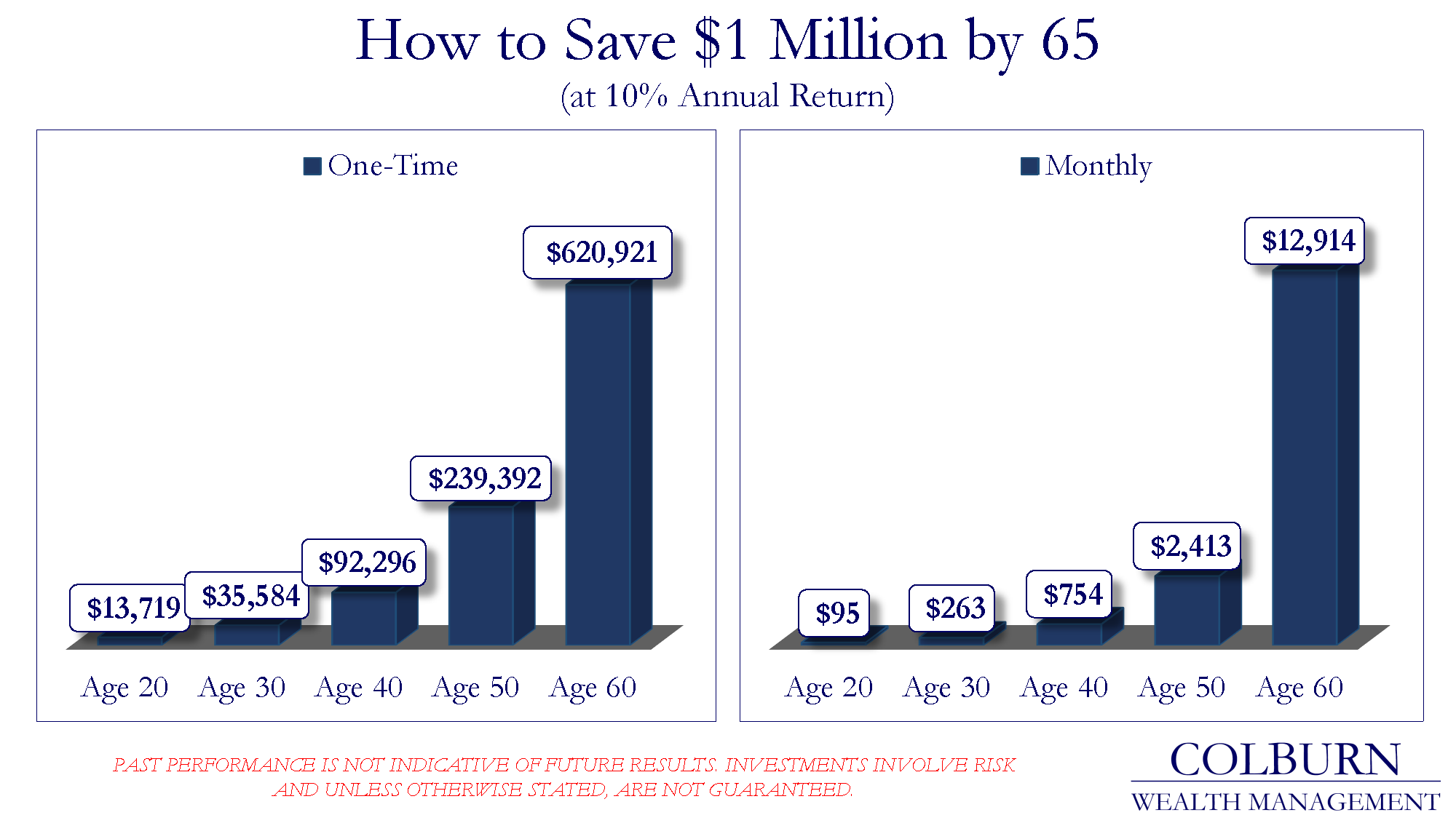

How to Save $1 Million by 65

We all know we should begin investing as early as possible to take the greatest advantage of compound interest growth. The graphics below highlight the power of compound growth based on the average long-term returns of the U.S. stock market.

The first chart represents the amount of investment required to accumulate $1M by age 65. For instance, a single investment of nearly $240K at age 50 is the same as a $14K investment at age 20. The 2nd graph covers the same concept; however, is based on an ongoing monthly investment. A 20 year old is required to save “only” $95 per month and a 40 year old more than seven times that amount to reach $1M by retirement.

Regardless of how long you have to accumulate money for your non-working years, each dollar saved today is likely to be much more valuable than a dollar invested 5 or 10 years down the road.

Dan Colburncan be reached at

740-831-4004or

info@colburnwm.com